Thank you for visiting the White Mountain Tuition Support website!

ARIZONA TAX CREDIT

Arizona provides a fantastic opportunity to help children obtain a values-based, Christian education with its tuition tax credit program. By taking advantage of this opportunity, Arizona taxpayers can donate money to the White Mountain Tuition Support Foundation (WMTSF) and receive a dollar for dollar tax credit when they file their Arizona tax return.

THIS COSTS THE TAXPAYER NOTHING!

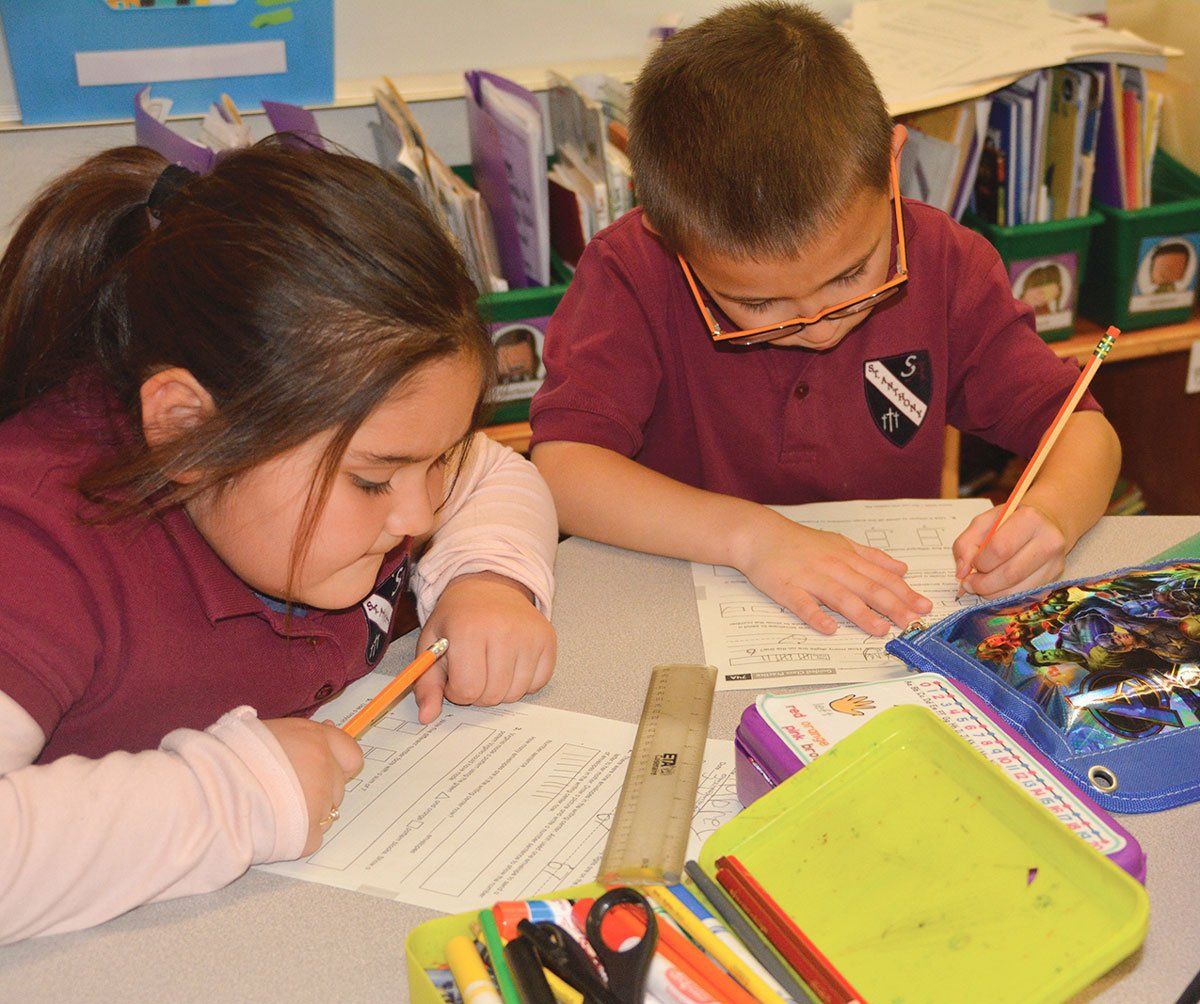

Donations to the WMTSF are used to fund scholarships for students at Saint Anthony School. Here is how it works:

Make a donation to the White Mountain Tuition Support Foundation; up to $1,535 (total) for single and head of household taxpayers or up to $3,062 (total) for a married couple filing jointly by April 15th, 2026. Broken down, you will be making donations to both the original ($769 and $1,535)and "Plus" ($766 and $1,527). Print, complete, and mail the form on the brochure with your donation to the address on the form.

For donations made April 16th through December 31st, 2025 you will receive an acknowledgement (for tax documentation purposes) by late January, by mail from the WMTSF. Donations made from January 1st through April 15th will be acknowledged immediately after the donation is received.

You will receive a dollar-for-dollar tax credit when you file your Arizona income tax return. A donation made January 1st through April 15th, 2026, may count as Arizona tax credit for the current or prior tax year. The money you donate will be used to fund scholarships for students in need of financial aid.